W Chart Pattern

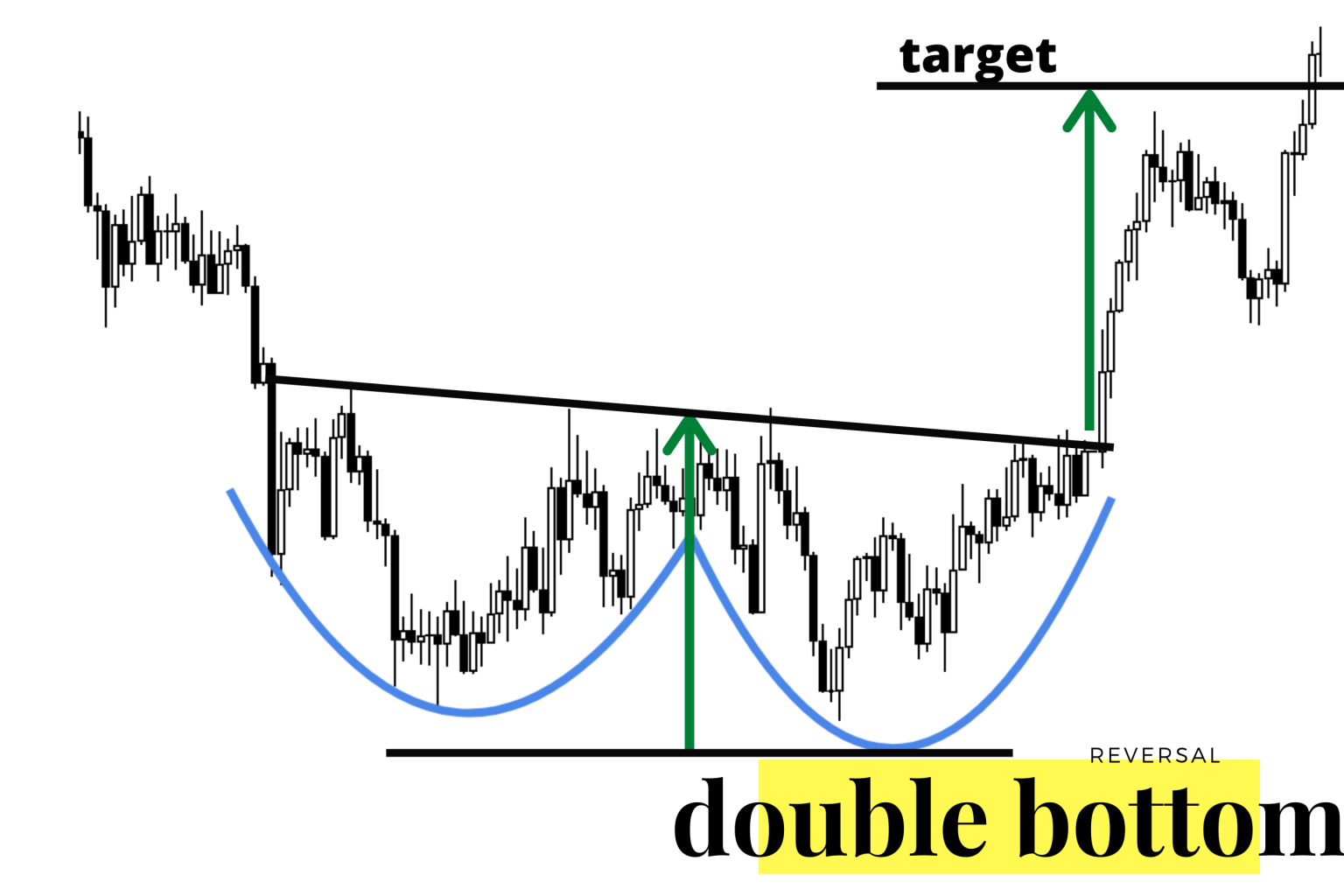

W Chart Pattern - Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. One popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. The pattern is characterized by two distinct troughs or peaks that mark. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. How to spot a double bottom pattern in a w pattern chart. It resembles the letter ‘w’ due to its structure formed by two consecutive price declines and recoveries. Web big w is a double bottom chart pattern with talls sides. A favorite of swing traders, the w pattern can be formed over a period. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. Importance of w pattern chart in trading strategies. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). The structure of w pattern: The difference between w pattern and other chart patterns. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. Understanding the fundamentals of w pattern chart in the stock market. The pattern is characterized by two distinct troughs or peaks that mark. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. Web in the world of forex trading, understanding patterns and trends can make all the difference between profit and loss. The difference between w pattern and other chart patterns. A favorite of swing traders, the w pattern can be formed over a period.. The structure of w pattern: Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author and trader. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. One popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. It. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). The pattern is characterized by two distinct troughs or peaks that mark. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the. How to spot a double bottom pattern in a w pattern chart. A favorite of swing traders, the w pattern can be formed over a period. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. Traders may use w bottoms and tops chart patterns as powerful indicators. The difference between w pattern and other chart patterns. Identifying double bottoms and reversals. How to spot a double bottom pattern in a w pattern chart. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. Web the w pattern in trading is a formation on price charts. Web in the world of forex trading, understanding patterns and trends can make all the difference between profit and loss. The structure of w pattern: Importance of w pattern chart in trading strategies. A favorite of swing traders, the w pattern can be formed over a period. Understanding the fundamentals of w pattern chart in the stock market. How to spot a double bottom pattern in a w pattern chart. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. Identifying double bottoms and reversals. Traders may use. The difference between w pattern and other chart patterns. Web overview of w bottoms and tops chart patterns. A favorite of swing traders, the w pattern can be formed over a period. Web big w is a double bottom chart pattern with talls sides. It is formed by drawing two downward legs followed by an upward move that retraces a. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. One popular pattern that traders often look out for is the double bottom, also known as the w pattern. The structure of w pattern: Importance of w pattern chart in trading strategies. It resembles the letter ‘w’ due to. Web big w is a double bottom chart pattern with talls sides. Understanding the fundamentals of w pattern chart in the stock market. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. One popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author and trader thomas bulkowski. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. The structure of w pattern: Web overview of w bottoms and tops chart patterns. Web in the world of forex trading, understanding patterns and trends can make all the difference between profit and loss. The difference between w pattern and other chart patterns. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. A favorite of swing traders, the w pattern can be formed over a period.Technical Analysis 101 A Pattern Forms the W Breakout Pattern!!

W pattern forex

W Pattern Trading New Trader U

Three Types of W Patterns MATI Trader

Stock Market Chart Analysis FORD Bullish W pattern

Wpattern — TradingView

W Forex Pattern Fast Scalping Forex Hedge Fund

W Pattern In Technical Analysis Zigzag Pattern Indicator Strategy CNRI

Three Types of W Patterns MATI Trader

W Pattern Trading The Forex Geek

How To Spot A Double Bottom Pattern In A W Pattern Chart.

Importance Of W Pattern Chart In Trading Strategies.

It Resembles The Letter ‘W’ Due To Its Structure Formed By Two Consecutive Price Declines And Recoveries.

The Pattern Is Characterized By Two Distinct Troughs Or Peaks That Mark.

Related Post: