Three White Soldiers Pattern

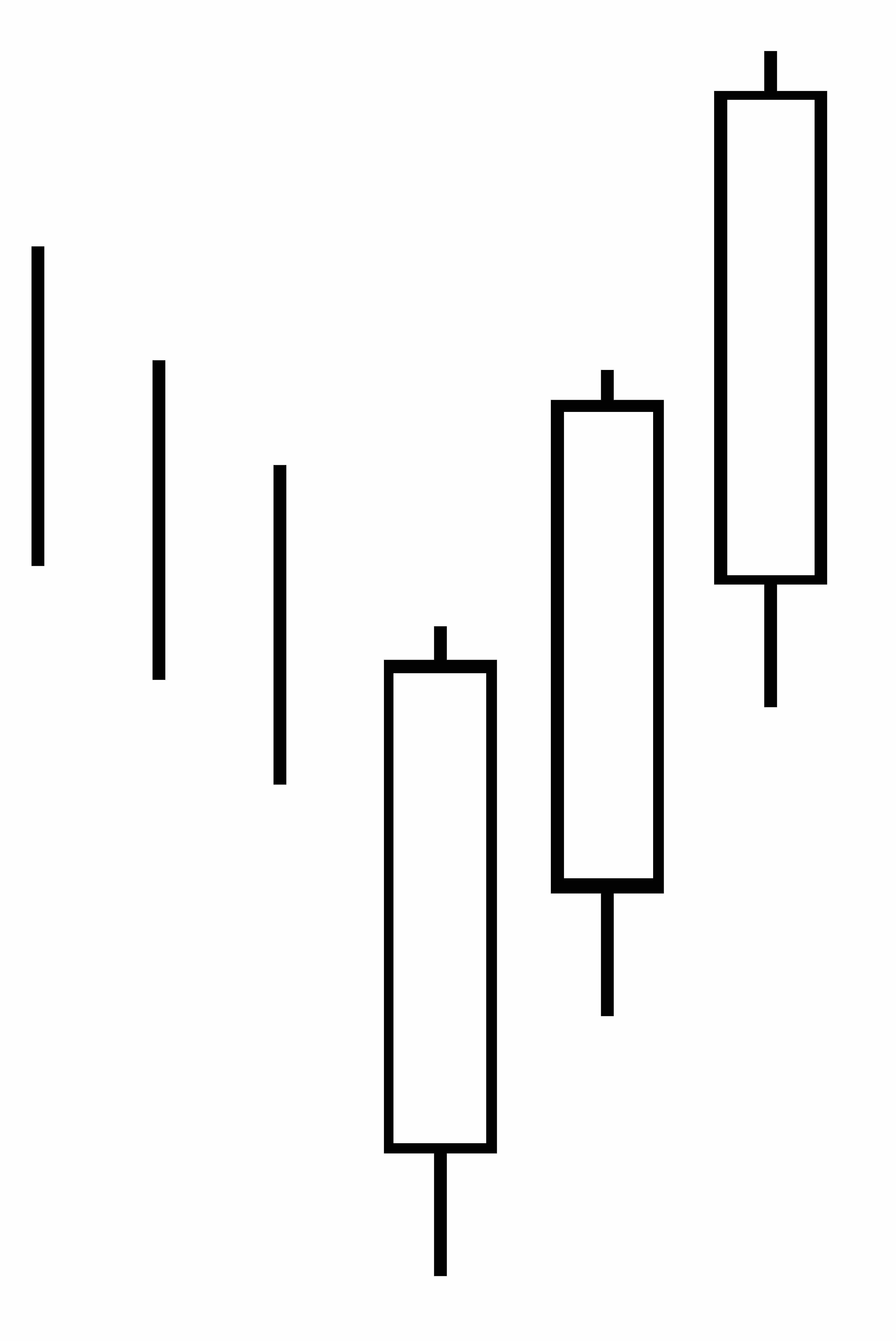

Three White Soldiers Pattern - Web what is a bullish three white soldiers pattern? As the name suggests, the pattern consists of three candles, which are green in colour. Web the three white soldiers pattern is a popular bullish candlestick pattern. It is fairly easy for most traders to spot in real time given the 3 large range successive candles. Today, let’s dive into a powerful candlestick pattern: The pattern has three consecutive candles, which will make them less frequent than some other candlestick patterns. Web but what is the three white soldiers pattern, and how does it appear on a chart? Three white soldiers patterns are made up of three consecutive bullish candlesticks. Learn more about this pattern, how to spot it, and what actions to take here in detail. Traders who are short in the market exit the market as soon as the three bullish candlesticks appear, indicating that momentum is shifting to the upside. As the name suggests, the pattern consists of three candles, which are green in colour. Web three white soldiers is a japanese candlestick pattern that consists of three green candles showing a bullish breakout. Traders interpret this charting formation as an indicator of a. Traders who are short in the market exit the market as soon as the three bullish candlesticks appear, indicating that momentum is shifting to the upside. Web as a triple candlestick pattern, the three white soldiers pattern consists of three consecutive bullish candlesticks at the bottom of a downward trend. This pattern is considered to be a bullish reversal pattern. This candlestick pattern signals an upcoming uptrend because of the strong buying pressure. Analysts and traders consider the three white soldiers pattern a fairly robust reversal signal. The bullish three white soldiers is a candlestick pattern signaling a bullish reversal at the end of a downtrend. During the second world war, some called the pattern the three marching soldiers. Web three white soldiers is a japanese candlestick pattern that consists of three green candles showing a bullish breakout. Web the three white soldiers pattern is a chart pattern seen in technical analysis. During the second world war, some called the pattern the three marching soldiers. Web the three white soldiers pattern had several names historically. Web the three white. Web the three white soldiers pattern is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. This pattern, characterized by three consecutive bullish candlesticks with progressively higher closes, often emerges. Web but what is the three white soldiers pattern, and how does it appear on a chart? As the name suggests, the pattern consists of three candles, which are green in colour. Web three white soldiers is a bullish trend reversal candlestick pattern consisting of three candles. During the second world war, some called the pattern the three marching soldiers.. Web three white soldiers is a candlestick chart pattern in the financial markets. Today, let’s dive into a powerful candlestick pattern: Moreover, in the right context it can signal a reversal of a trend. Learn more about this pattern, how to spot it, and what actions to take here in detail. Japanese called it the three red soldiers, because what. Appearing after the downtrend, all the three candles are long and bullish; It suggests a potential shift in market sentiment from bearish to bullish and can indicate the beginning of an uptrend. Traders who are short in the market exit the market as soon as the three bullish candlesticks appear, indicating that momentum is shifting to the upside. Web three. Web the three white soldiers is a bullish japanese candlestick reversal pattern consisting of three consecutive white bodies, each with a higher close. This candlestick pattern signals an upcoming uptrend because of the strong buying pressure. The pattern suggests a reversal of a bearish trend. Web the three white soldiers pattern is a robust bullish reversal signal, particularly when validated. As the name suggests, the pattern consists of three candles, which are green in colour. This chart pattern suggests a strong change in. Here are the characteristics of a. It consists of three consecutive tall bullish candles, all closing in the upper quarter of their range. Web the three white soldiers is a reliable entry and exit signal. Web three white soldiers is a bullish trend reversal candlestick pattern consisting of three candles. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. Web as a triple candlestick pattern, the three white soldiers pattern consists of three consecutive bullish candlesticks at the. Web the three white soldiers pattern is a chart pattern seen in technical analysis. Web as a triple candlestick pattern, the three white soldiers pattern consists of three consecutive bullish candlesticks at the bottom of a downward trend. It is fairly easy for most traders to spot in real time given the 3 large range successive candles. Web the three. Web the three white soldiers pattern had several names historically. Web the three white soldiers is a reliable entry and exit signal. It is fairly easy for most traders to spot in real time given the 3 large range successive candles. Web as a triple candlestick pattern, the three white soldiers pattern consists of three consecutive bullish candlesticks at the. Each candle's open price is within the previous candle's body; Web the three white soldiers pattern is a chart pattern seen in technical analysis. Web the three white soldiers pattern is a bullish candlestick formation on a trading chart that occurs at the bottom of a downtrend. Moreover, in the right context it can signal a reversal of a trend. This candlestick pattern signals an upcoming uptrend because of the strong buying pressure. Web the three white soldiers candlestick pattern is a powerful indicator in technical analysis, particularly in its ability to signal the exhaustion of selling pressure in financial markets. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. Web the three white soldiers pattern explained. Web the three white soldiers pattern is a robust bullish reversal signal, particularly when validated by additional confluence factors. Web the three white soldiers pattern is a reversal pattern that predicts a change in the direction of a trend. It generally occurs at the bottom of a market downtrend, indicating a reversal is about to break out. The pattern suggests a reversal of a bearish trend. Web as a triple candlestick pattern, the three white soldiers pattern consists of three consecutive bullish candlesticks at the bottom of a downward trend. Web three white soldiers. The bullish three white soldiers is a candlestick pattern signaling a bullish reversal at the end of a downtrend. It suggests a potential shift in market sentiment from bearish to bullish and can indicate the beginning of an uptrend.Three White Soldiers Pattern Morpher

Three white Soldiers is a bullish pattern that occurs when the price of

Three White Soldiers Chart Pattern A Visual Reference of Charts

Three White Soldiers — Trend Analysis — TradingView

Candlestick Patterns The Definitive Guide (2021)

How to Trade the Three White Soldiers Candlestick Pattern IG

Three White Soldiers Candlestick Pattern Meaning, Success Rate

What Are Three White Soldiers Candlestick Explained ELM

Three White Soldiers Candlestick Formation and How To Trade Using it

Understanding the Three White Soldiers Pattern Premium Store

It Unfolds Across Three Trading Sessions And Represents A Strong Price Reversal From A Bear Market To A Bull Market.

Web Three White Soldiers Is A Bullish Trend Reversal Candlestick Pattern Consisting Of Three Candles.

By Integrating This Pattern Into A Comprehensive Trading Strategy And Practicing Disciplined Risk Management, Traders Can Capitalize On Potential Uptrends And Maximize Their Chances Of Successful Trades.

Appearing After The Downtrend, All The Three Candles Are Long And Bullish;

Related Post: