Shooting Star Candlestick Pattern

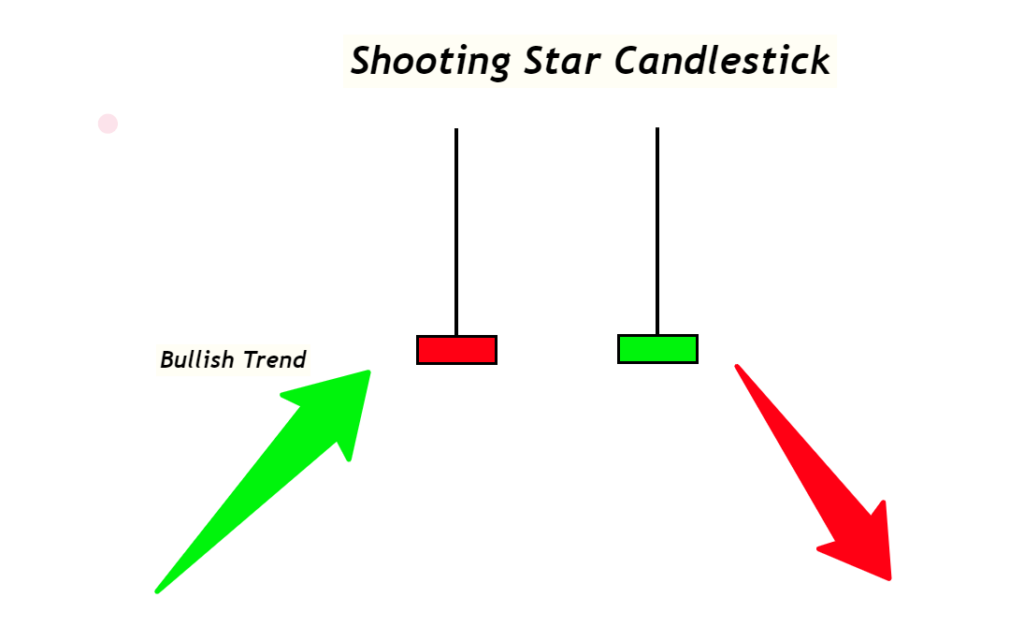

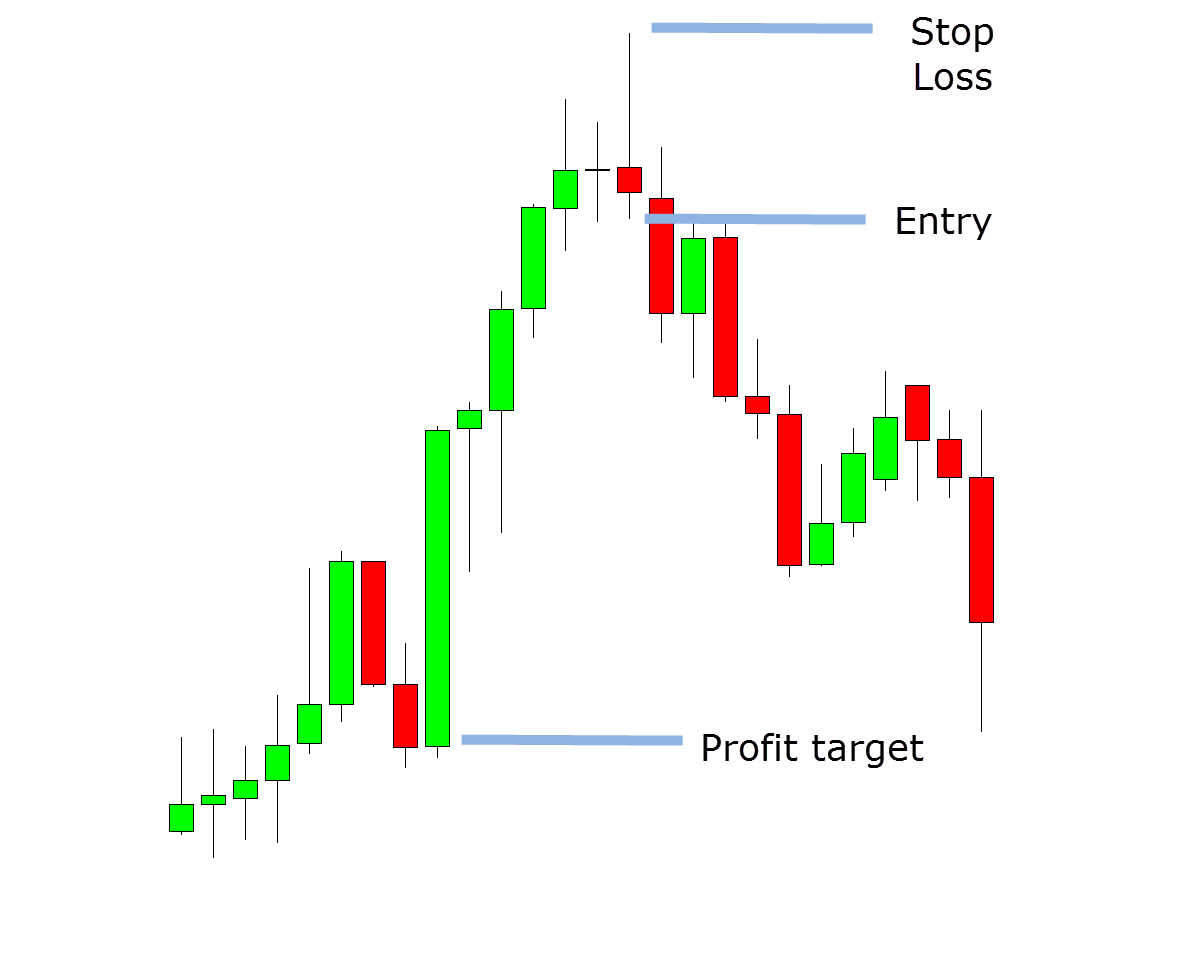

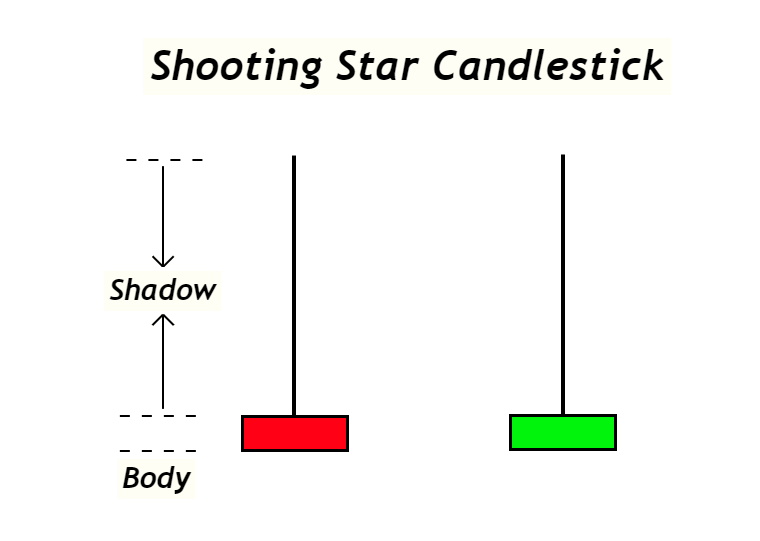

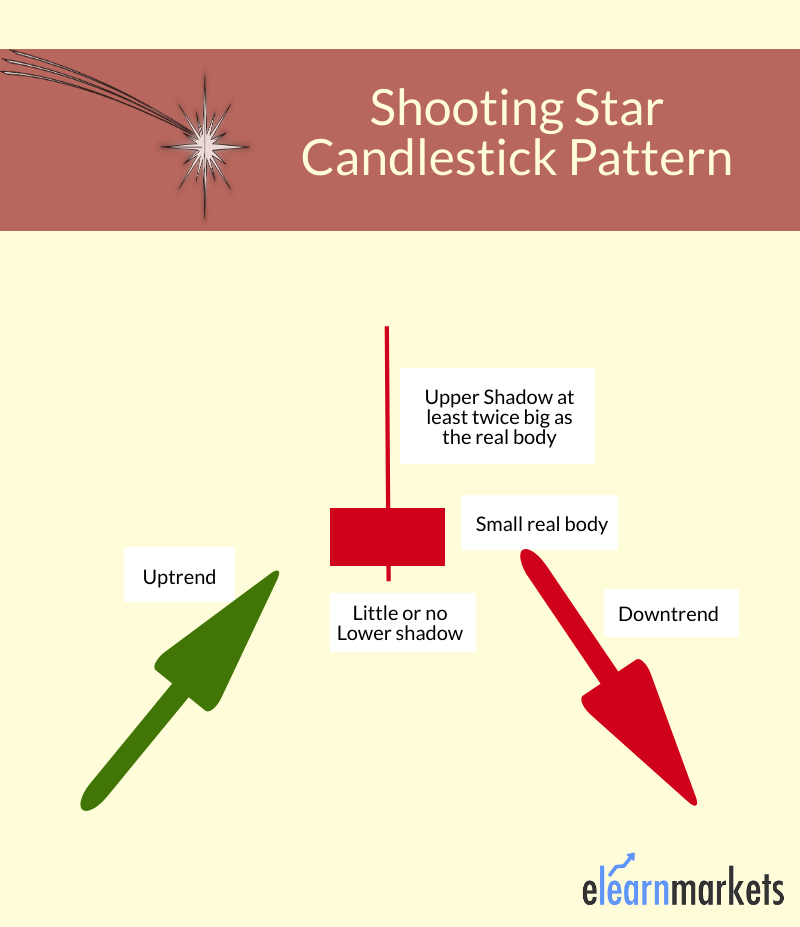

Shooting Star Candlestick Pattern - When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Web a shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then closes near the open price. Web what is a shooting star candlestick pattern? The shooting star is actually the hammer candle turned upside down, very. That being said, you can also have. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. When the price advances and shows. This pattern is a prime example of how candlestick. It forms after a price swing high, indicating potential price decline. Shooting star vs inverted hammer. Shooting star vs inverted hammer. A shooting star usually forms at the end of an uptrend. Web shooting star patterns indicate that the price has peaked and a reversal is coming. Web the shooting star candlestick is a japanese candlestick pattern type where the candle has a long upper shadow and a short lower shadow. How to spot a signal using a shooting star pattern. It comes after an uptrend. It is viewed as a bearish reversal candlestick. Web the shooting star is a reversal candlestick pattern commonly used by forex traders. It is characterized by a single. This pattern is a prime example of how candlestick. The shooting star is a bearish reversal pattern that typically occurs at the end of an uptrend. Web the shooting star is a reversal candlestick pattern commonly used by forex traders. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. How to trade this pattern. Candlestick patterns are most effective when they appear at. It also has a small real body. The inverted hammer occurs at the end of a down trend. Web what is the shooting star candlestick pattern? When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Quick guide for traders #candlestickpatterns #technicalanalysis learn to spot the shooting star candlestick pattern in this brief,. It features a small lower body with a long upper shadow, indicating a. Web shooting star candlestick pattern: Web in technical analysis, the shooting star candlestick pattern plays a pivotal role in signaling potential bearish reversals. Shooting star vs inverted hammer. The shooting star appears in an uptrend and signifies a drop in price. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. A shooting star usually forms at the end of an uptrend. That being said, you can also have. Web in technical analysis, the shooting star candlestick pattern plays a pivotal role in signaling potential bearish reversals. Web a shooting star pattern. Web the shooting star candlestick pattern is a bearish reversal pattern. Web what is a shooting star candlestick pattern? It is characterized by a single. It features a small lower body with a long upper shadow, indicating a. Candlestick patterns are most effective when they appear at key. The candlestick has a long upper shadow. This pattern is a prime example of how candlestick. Candlestick patterns are most effective when they appear at key. It forms after a price swing high, indicating potential price decline. A shooting star usually forms at the end of an uptrend. There are also bearish and bullish engulfing patterns. It also has a small real body. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. The candlestick has a long upper shadow. The shooting star is a bearish reversal pattern that typically occurs at the end of an uptrend. Web the shooting star candle is a reversal pattern of an upwards price move. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web shooting star patterns indicate that the price has peaked and a reversal is coming. There are also bearish and bullish engulfing patterns. When the price advances. Web the shooting star candle is a reversal pattern of an upwards price move. It comes after an uptrend. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web a shooting star pattern is found at the top of an uptrend, when the trend is losing its momentum. A shooting. Web how to spot it. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. The shooting star is actually the hammer candle turned upside down, very. Shooting star vs inverted hammer. After an uptrend, the shooting star pattern. Candlestick patterns are most effective when they appear at key. The shooting star appears in an uptrend and signifies a drop in price. Web a shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then closes near the open price. Web a shooting star pattern is found at the top of an uptrend, when the trend is losing its momentum. Web hammer and shooting star examples: Web the shooting star pattern is considered a bearish candlestick pattern as it occurs at the top of an uptrend and is typically followed by the price retreating lower. When the price advances and shows. Web the shooting star is a reversal candlestick pattern commonly used by forex traders. The inverted hammer occurs at the end of a down trend. Web the shooting star candle is a reversal pattern of an upwards price move. Quick guide for traders #candlestickpatterns #technicalanalysis learn to spot the shooting star candlestick pattern in this brief,. Web what is a shooting star candlestick pattern? A shooting star usually forms at the end of an uptrend. The shooting star is actually the hammer candle turned upside down, very. Web what is the shooting star candlestick pattern? There are also bearish and bullish engulfing patterns.A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Candlestick Patterns The Definitive Guide (2021)

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Candlestick Pattern How to Identify and Trade

How to spot and use the Shooting Star Candlestick Pattern DTTW™

Candlestick shooting star pattern strategy ( A to Z ) YouTube

Shooting Star Candlestick Pattern How to Identify and Trade

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

What Is Shooting Star Candlestick With Examples ELM

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

It Features A Small Lower Body With A Long Upper Shadow, Indicating A.

Web A Shooting Star Candlestick Pattern Occurs When An Appreciating Asset Abruptly Reverses Lower, Leaving Behind A Long Upward Wick.

It Comes After An Uptrend.

It’s A Reversal Pattern And Is Believed To Signal An Imminent Bearish Trend Reversal.

Related Post: