Bearish Hammer Candlestick Pattern

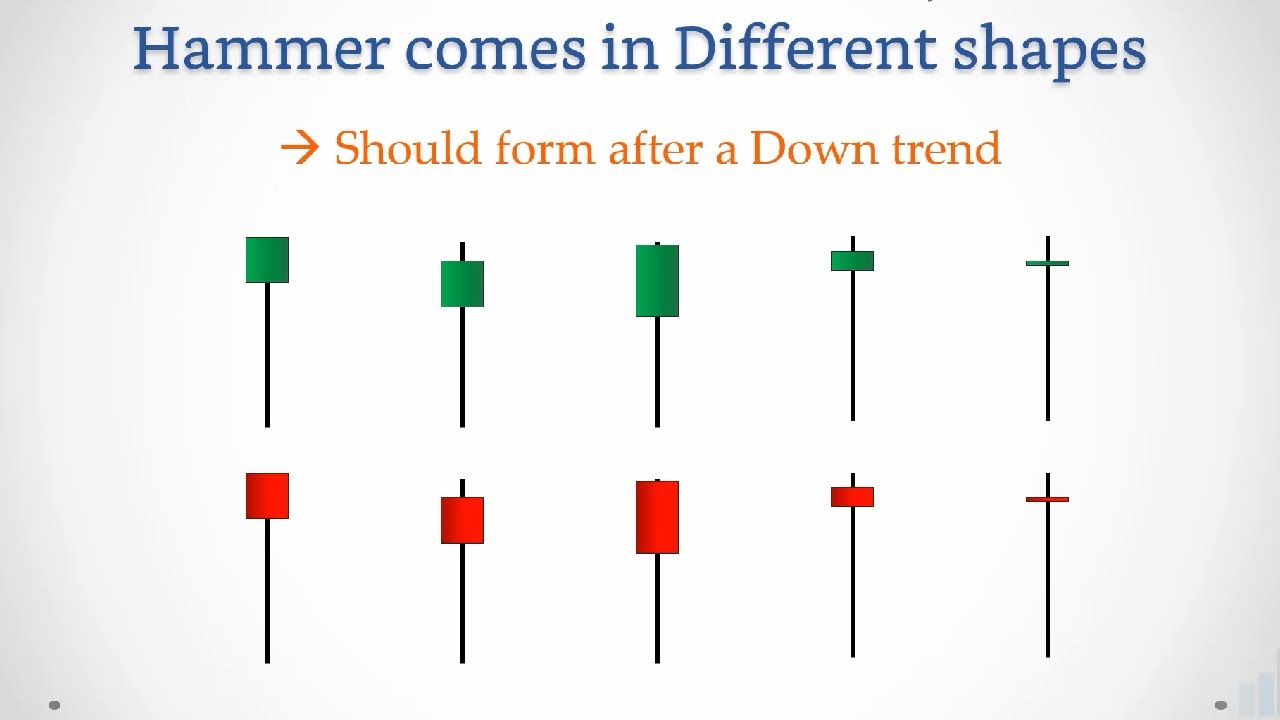

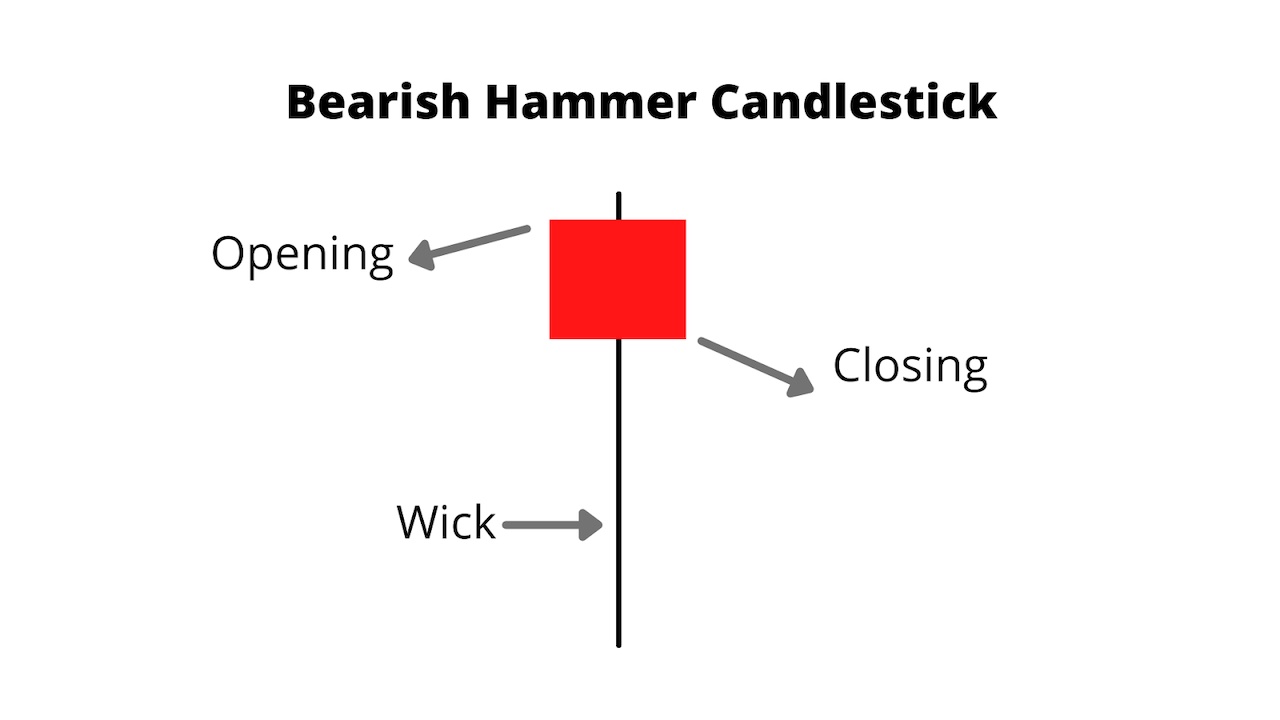

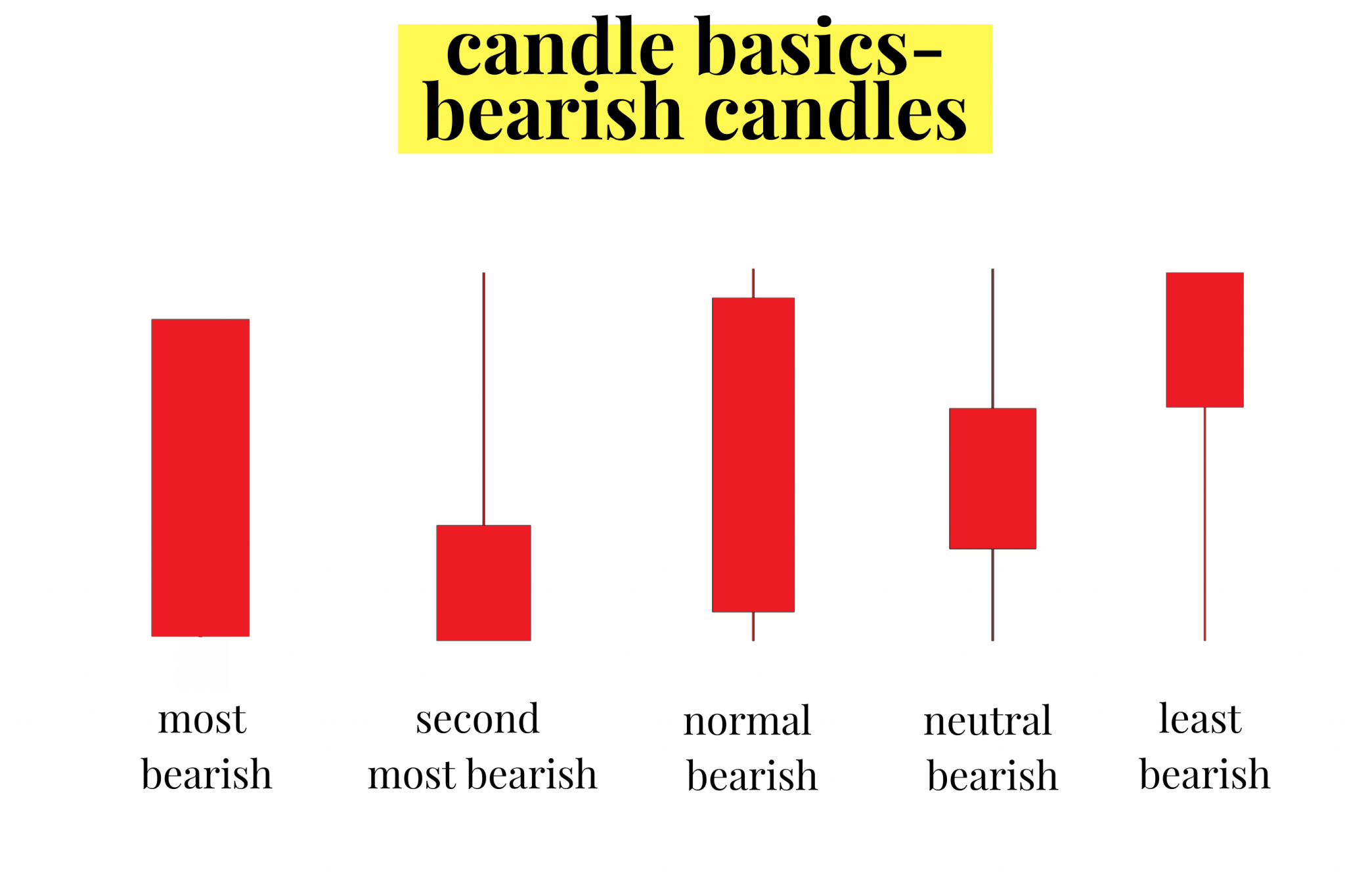

Bearish Hammer Candlestick Pattern - The hammer helps traders visualize where support and demand are located. Using a hammer candlestick pattern in trading; Lower shadow more than twice the length of the body. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Occurrence after bearish price movement. When you see a hammer candlestick, it's often seen as a positive sign for investors. Advantages and limitations of the hammer chart pattern; Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. Advantages and limitations of the hammer chart pattern; Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web what is a hammer candle pattern? Further reading on trading with candlestick. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. These candles are typically green or white on stock charts. This is known commonly as an inverted hammer candlestick. Web what is a hammer candle pattern? Web hammer candlesticks are a popular reversal pattern formation found at the bottom. Examples of use as a trading indicator. The hammer helps traders visualize where support and demand are located. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. After a downtrend, the hammer can signal to traders that the downtrend could be over and that short positions could.. After a downtrend, the hammer can signal to traders that the downtrend could be over and that short positions could. Examples of use as a trading indicator. They consist of small to medium size lower shadows, a real body, and little to no upper wick. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and.. Examples of use as a trading indicator. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. Web. The hammer helps traders visualize where support and demand are located. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Using a hammer candlestick pattern in trading; Examples of use as a trading indicator. Web what is a hammer candle pattern? Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Lower shadow more than twice the length of the body. Occurrence after bearish price movement. Web the hammer candlestick formation is viewed. Using a hammer candlestick pattern in trading; Advantages and limitations of the hammer chart pattern; Examples of use as a trading indicator. Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower. It has a small candle body and a long lower wick. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Further reading on trading with candlestick. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. It has a small real body positioned. Occurrence after bearish price movement. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web what is a hammer candle pattern? Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Small. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. Occurrence after bearish price movement. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web. Further reading on trading with candlestick. After a downtrend, the hammer can signal to traders that the downtrend could be over and that short positions could. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. This is known commonly as an inverted hammer candlestick. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. Occurrence after bearish price movement. It has a small candle body and a long lower wick. Lower shadow more than twice the length of the body. These candles are typically green or white on stock charts. Examples of use as a trading indicator. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. The hammer helps traders visualize where support and demand are located. Web what is a hammer candle pattern? Typically, it's either red or black on stock charts. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and.Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Hammer Doji Candlestick Detector Metatrader Indicator

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Comment Trader avec des modèles Hammer Candlestick (chandeliers en

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish Inverted Hammer Candlestick Patterns

Hammer Candlestick Example & How To Use 2024

Candlestick Patterns Explained New Trader U

It Has A Small Real Body Positioned At The Top Of The Candlestick Range And A Long Lower Shadow That Is.

Web A Hammer Is A Price Pattern In Candlestick Charting That Occurs When A Security Trades Significantly Lower Than Its Opening, But Rallies Within The Period To Close Near The Opening Price.

When You See A Hammer Candlestick, It's Often Seen As A Positive Sign For Investors.

Advantages And Limitations Of The Hammer Chart Pattern;

Related Post: